Infima's Deep Learning Technologies Set New Mortgage-Backed Security Analytics Standards, Broadening Coverage

ACCESS Newswire

20 Sep 2022, 18:31 GMT+10

The Addition of Ginnie Mae Bonds Expands Total Coverage to Over 525,000 Securities, Backed by Roughly 35 Million Home Loans

SAN MATEO, CA / ACCESSWIRE / September 20, 2022 / Infima, a fixed-income predictive analytics provider, announced today that it has expanded its coverage of mortgage securities (MBS) to bonds backed by government agency Ginnie Mae. This expansion beyond Fannie Mae and Freddie Mac MBS completes Infima's coverage of a major fixed-income asset class with a current market value of more than $10 trillion. It extends Infima's advanced prepayment projections and analytics to an additional 200,000 securities, bringing total coverage to over 525,000 Agency MBS backed by roughly 35 million home loans.

Powered by transformative deep learning technologies that harness data of unprecedented size and granularity, Infima's MBS prepayment projections and analytics continue to exhibit superior performance during the dramatic rise in interest rates witnessed this year. This extends an exceptionally strong multi-year performance record that also covers the disruptive market conditions during the pandemic, which challenged conventional prepayment systems. Infima now delivers the benefits of these innovative AI technologies to investors and dealers in Ginnie Mae MBS, enabling portfolio managers and traders to identify valuable opportunities and spot risks across the entire Agency MBS market.

'Infima's deep learning system analyzes the behavior of tens of millions of mortgage borrowers at the most granular level, harnessing billions of data points spanning multiple economic cycles including the financial crisis of 2007-09,' said Kay Giesecke, Chief Scientist and Founder. 'It uncovers stable patterns in individual borrower behavior that conventional approaches miss, enabling robust and reliable forecasts of future borrower, security and market behavior even in unusual economic regimes such as the current environment with mortgage rates above 6%.'

Infima's prepayment projections and analytics set new performance standards for the Agency MBS market, enabling high-confidence investment and trading decisions in all market conditions, and delivering superior portfolio construction, security selection and risk management to market participants on the buy and sell-sides.

About Infima

Infima's unique deep learning technologies are transforming mortgage security analytics. Its solutions offer actionable predictive insights into future borrower, security, and market behavior, enabling investors, dealers, and other market participants to make better decisions to drive performance. A 10x improvement in predictive accuracy vs. legacy solutions delivers superior portfolio construction, security selection and risk management to portfolio managers, traders, and other mortgage market participants. Infima currently covers more than 525,000 mortgage securities which are backed by roughly 35 million mortgage loans and represent a total current market value of almost $10 trillion. To learn more, visit infima.io.

Contact:

Caliber Corporate Advisers

[email protected]

SOURCE: Infima

View source version on accesswire.com:

https://www.accesswire.com/716594/Infimas-Deep-Learning-Technologies-Set-New-Mortgage-Backed-Security-Analytics-Standards-Broadening-Coverage

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Memphis Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Memphis Sun.

More InformationInternational

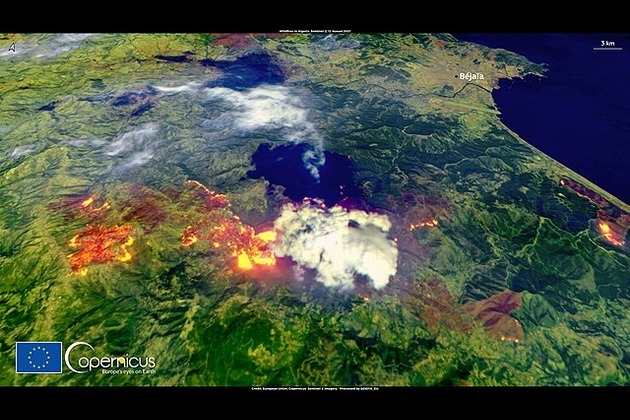

SectionTurkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

New French law targets smoking near schools, public spaces

PARIS, France: France is taking stronger steps to reduce smoking. A new health rule announced on Saturday will soon ban smoking in...

Trump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Native leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

Business

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...