INVESTOR REMINDER: Berger Montague Advises Investors Of A Securities Fraud Action Filed Against RENT THE RUNWAY, INC. (NASDAQ: RENT); Lead Plaintiff Deadline is January 13, 2023

ACCESS Newswire

23 Nov 2022, 20:25 GMT+10

PHILADELPHIA, PA / ACCESSWIRE / November 23, 2022 / Berger Montague advises investors that a securities fraud class action lawsuit has been filed against Rent the Runway, Inc. ('RTR') (NASDAQ: RENT) on behalf of those who purchased Class A common stock issued in connection with RTR's October 2021 initial public offering (the 'IPO').

Investor Deadline: Investors who purchased or acquired RTR Class A common stock may, no later than January 13, 2023, seek to be appointed as a lead plaintiff representative of the class. For additional information or to learn how to participate in this litigation, please contact Berger Montague: James Maro at [email protected] or (215) 875-3093, or Andrew Abramowitz at [email protected] or (215) 875-3015 or visit: https://investigations.bergermontague.com/rent-the-runway/

RTR is an e-commerce platform that allows users to rent, subscribe, or buy designer apparel and accessories. RTR offers high-end apparel such as evening wear and accessories, as well as more causal and mixed-use items such as ready-to-wear, workwear, denim, maternity, outerwear, blouses, knitwear, loungewear, jewelry, handbags, activewear, ski wear, home goods, and kidswear. RTR sources its products from over 750 luxury brand partners.

On October 4, 2021, RTR filed with the SEC a registration statement on a Form S-1 for the IPO, which, after several amendments, was declared effective on October 26, 2021 (the 'Registration Statement'). On October 27, 2021, RTR filed with the SEC a prospectus for the IPO on a Form 424B4, which incorporated and formed part of the Registration Statement (the 'Prospectus'). The Registration Statement and Prospectus were used to sell to the investing public 17 million shares of RTR Class A common stock at $21 per share for $357 million in gross offering proceeds.

According to the complaint, RTR failed to disclose in its Registration Statement and Prospectus the following adverse facts that existed at the time of the IPO: (a) RTR was continuing to face extraordinary business headwinds, such as transportation headwinds and labor wage rate increases, from the COVID-19 pandemic; (b) RTR's active subscriber enrollments had sharply decelerated from the growth trajectory represented in the Registration Statement and, as a result, RTR was several months away from approaching its pre-pandemic levels of active subscriptions; (c) RTR needed to substantially increase marketing and advertising costs from historical figures in order to attempt to grow its active subscriber network; (d) RTR was suffering from ballooning fulfillment and transportation costs; and (e) as a result of the above, RTR was suffering accelerating operational losses at the time of the IPO and was far less likely to achieve profitability in the near term, if ever, than represented.

At the time the complaint was filed, RTR's stock traded below $2 per share, or over 90% below the IPO price.

A lead plaintiff is a representative party that acts on behalf of other class members in directing the litigation. In order to be appointed lead plaintiff, the Court must determine that the class member's claim is typical of the claims of other class members, and that the class member will adequately represent the class. Your ability to share in any recovery is not, however, affected by the decision whether or not to serve as a lead plaintiff. Communicating with any counsel is not necessary to participate or share in any recovery achieved in this case. Any member of the purported class may move the Court to serve as a lead plaintiff through counsel of his/her choice, or may choose to do nothing and remain an inactive class member.

Berger Montague, with offices in Philadelphia, Minneapolis, Washington, D.C., and San Diego, has been a pioneer in securities class action litigation since its founding in 1970. Berger Montague has represented individual and institutional investors for over five decades and serves as lead counsel in courts throughout the United States.

Contacts:

James Maro, Senior Counsel

Berger Montague

(215) 875-3093

[email protected]

Andrew Abramowitz, Senior Counsel

Berger Montague

(215) 875-3015

[email protected]

SOURCE: Berger Montague

View source version on accesswire.com:

https://www.accesswire.com/727761/INVESTOR-REMINDER-Berger-Montague-Advises-Investors-Of-A-Securities-Fraud-Action-Filed-Against-RENT-THE-RUNWAY-INC-NASDAQ-RENT-Lead-Plaintiff-Deadline-is-January-13-2023

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Memphis Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Memphis Sun.

More InformationInternational

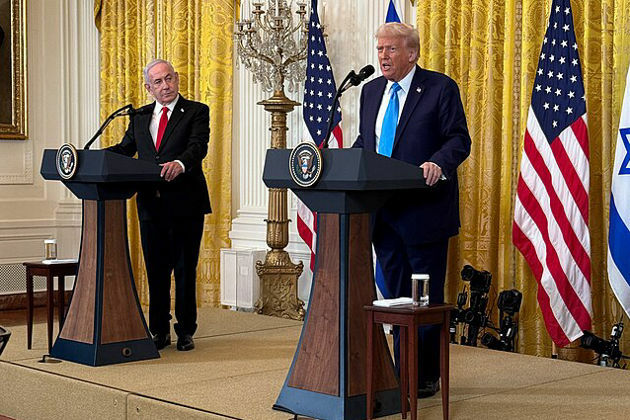

SectionWhite House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...

Over 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

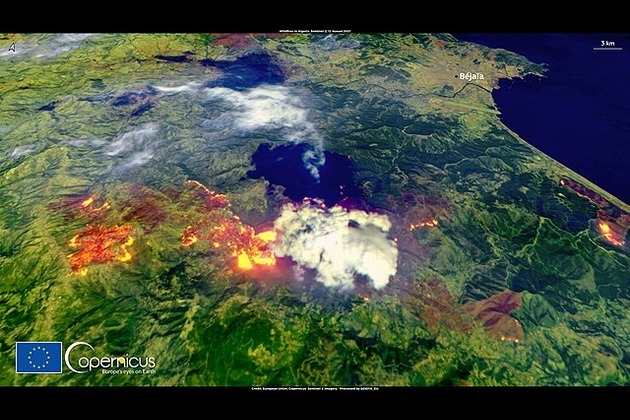

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Business

SectionGrammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Standard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...